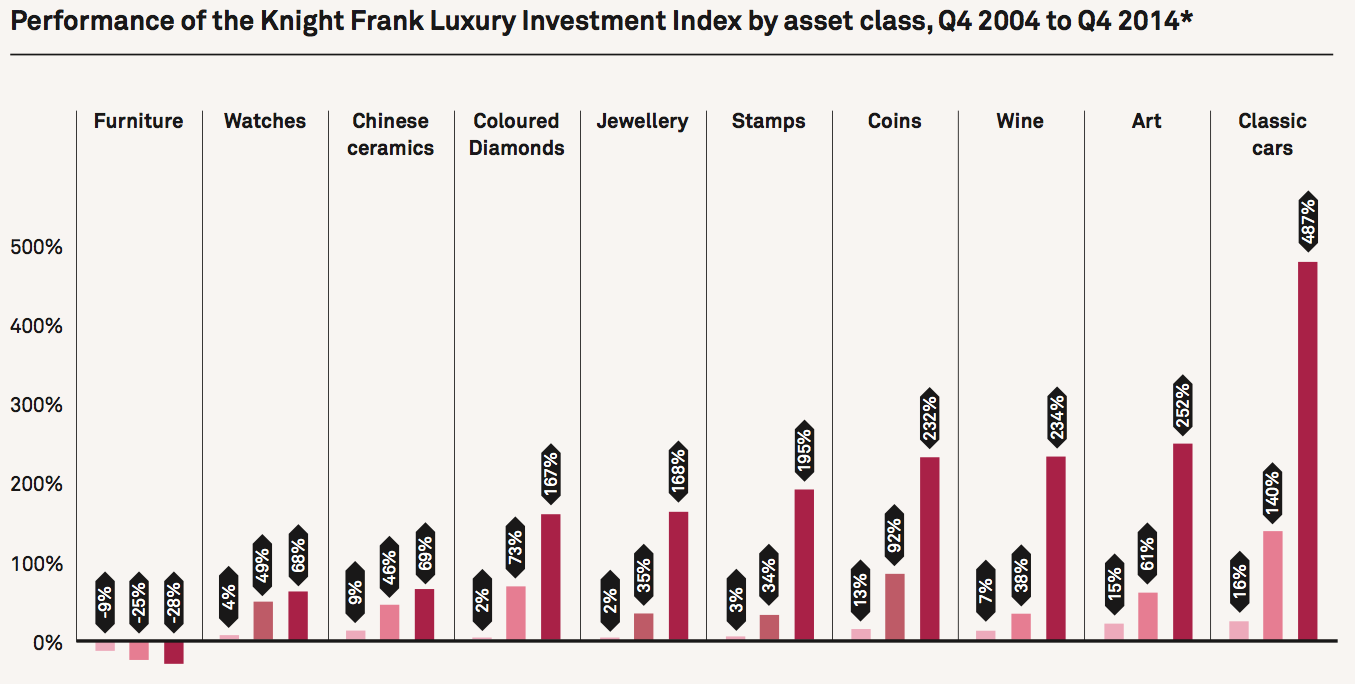

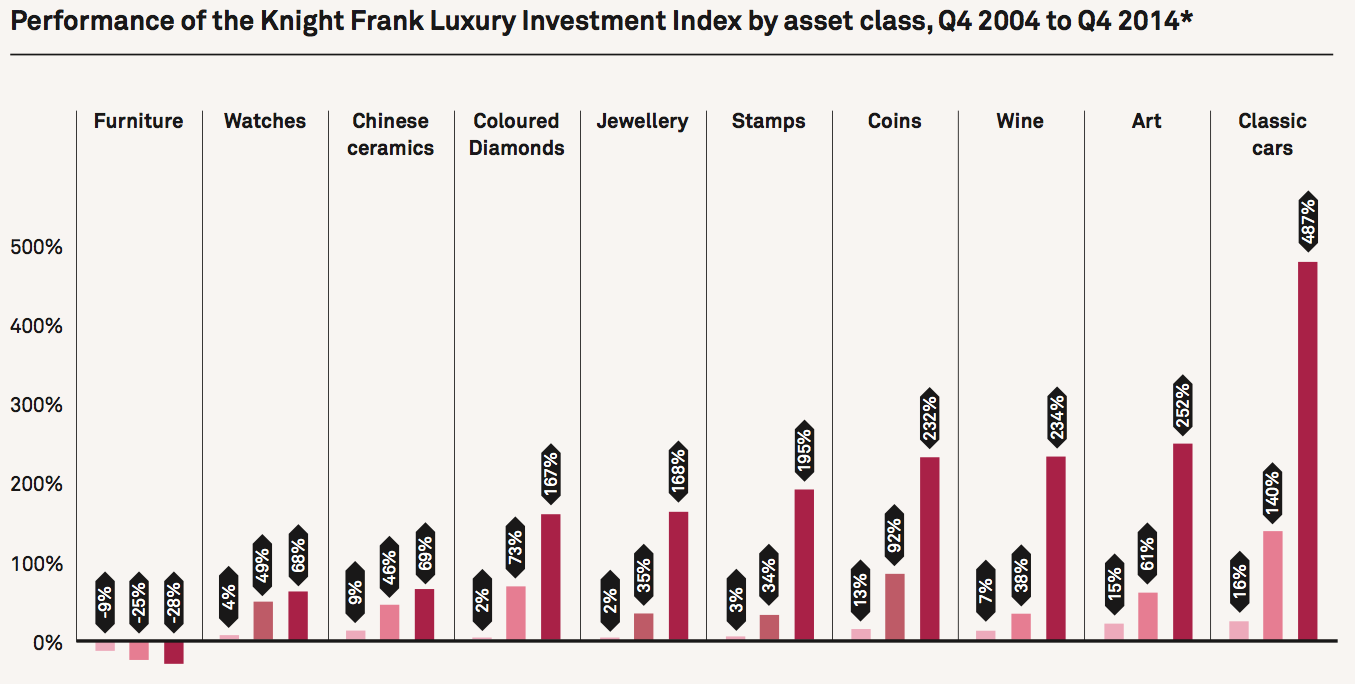

Over the last decade, prices of luxury assets have increased significantly. In fact, the rate of return on luxury assets has outstripped the return on many conventional asset classes. For example, the Knight Frank Luxury Investment Index has risen by 205% in the past decade. However, even within the universe of luxury assets, classic cars have stood out as the strongest performer with a price increase of a whopping 487% over the last decade.

But there is more to the classic car market over the last decade than just a rise in prices. Classic cars have emerged as a genuine investable asset class with increasing transaction volumes and liquidity, the rise of classic car funds and an increasingly reliable price data.

Increasing Volumes: As the Times noted in an article this weekend, this increase in prices has coincided with a significant increase in volumes sold (up 50% to $1.16 billion last year).

Classic Car Funds: In another sign of the maturation of the classic car market, classic care funds now allow investors to own a share in a collection of cars.

Reliable Price Data: Sources such as Hagerty provide a reliable source of data on a wide range of classic cars.

Just like wine emerged as an asset class a decade ago, classic cars have now completed the same transition from a fringe investable asset to an increasingly mainstream one.

Contact us if you need a loan against your classic car but do not want to sell it.

WhatsApp Us

WhatsApp Us