Case Studies: How Unbolted can finance your growth

Luxury watch shop: Financing higher end watches

What the Client Says: “In the three years we have dealt with Unbolted our average sale has gone up from around £10k to £60k. We are now even comfortable selling £300k Richard Mille watches. The Banks do not understand this market and we grew frustrated by the limited facilities they could offer. Unbolted understood the challenge and have enabled us to leverage our existing stock and facilitate this strategic and valuable move up market.”

Forum Auctions: Pre-auction financing - direct to vendors

What the Client Says: We have worked with Unbolted Auction Finance for over a year now. The Auction Advance facility for vendors has proved very popular and has provided over £1million in liquidity to our vendors. When pitching for the best lots this Finance Facility has been a very useful tool. The admin process with Unbolted is pain free, both for us and the vendor, and the Interest charges are sensible. We can account for everything as part of the normal sales proceeds process so we don’t have to inconvenience the vendor with monthly payments. Furthermore, vendors are attracted by the non-recourse nature of these advances, thereby having no impact on their own credit ratings. Unbolted’s finance facility really is a win-win for all concerned.” Stephan Ludwig - CEO, Forum Auctions.

London fine art gallery: Financing of art stock

Established for over 25yrs the art gallery is based in London’s South Kensington. In common with other fine art dealers, the gallery is committed to keep their stock offer varied and fresh. The requirement to constantly buy and sell can put a strain on liquidity, especially when a tempting purchase opportunity presents itself at an awkward time.

What the Client Says: “Unbolted understands our requirements and delivers a platform for us to grow. They are professional and understanding and we share the same vision.”

Online watch dealer: Financing of pre-owned watch stock

What the Client Says: “After using the Unbolted facility for only 6 months we have already doubled our stock in hand and sales. The interest we pay Unbolted is reasonable and the facility can be increased up or down to help us adapt to market conditions. We make a healthy profit on this new incremental business and of course the monthly interest costs can be offset against profits, which is very tax efficient. Best of all we can now offer our customers the widest selection of watches we ever had.”

Independent art collector: Launch commercially

What the Client Says: “I was bored during the pandemic and wanted to start trading art commercially. My existing collection was nice but I had to scale it up to be commercially successful. Unbolted enabled me to make this transition based on the art I already owned which was important as all of my personal capital was locked up in my closed hospitality business. The administration of my loans and multiple assets is simple via the online platform.”

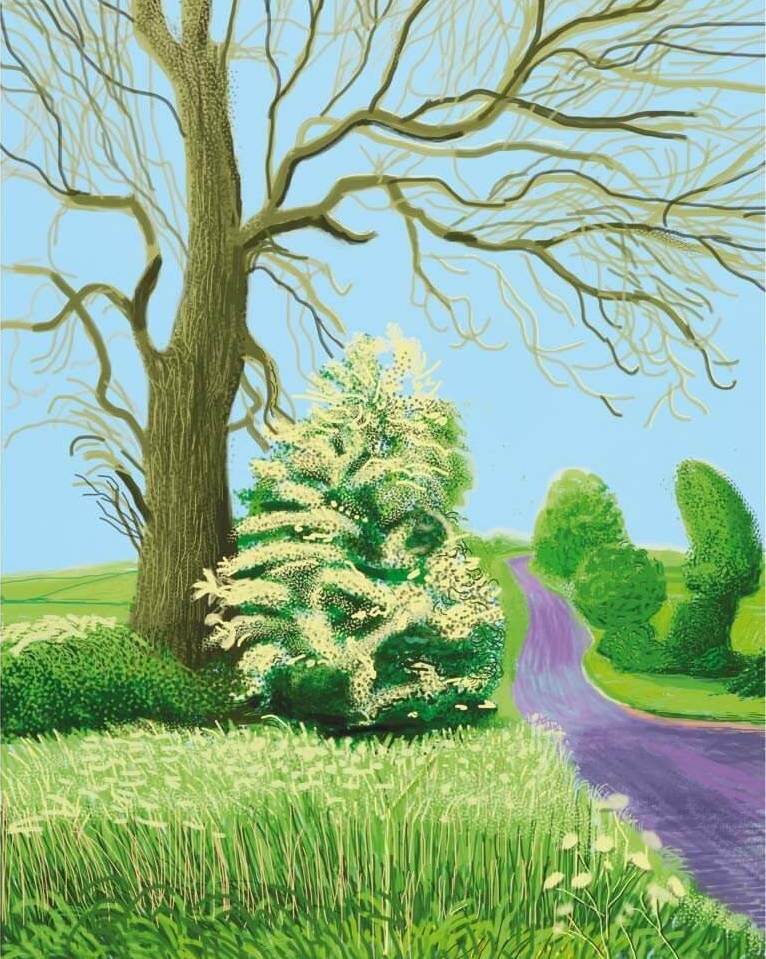

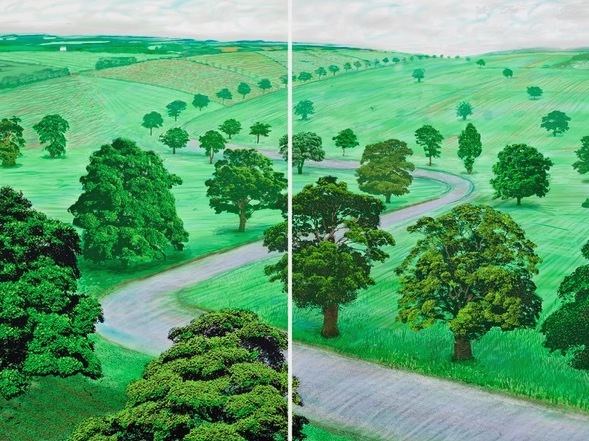

Secure a transatlantic Hockney deal

What the Client Says: “I had a ready buyer via a US gallery for some Hockney Art. There was a fair profit in the deal that I could plough back into my collection but I just didn’t have the funds up front to buy the piece in the first place. The Unbolted facility came just in time otherwise I would have missed out.”

Use Banksy collection to complete property deal

What the Client Says: “With Banksy works rising in value month on month it made no sense to sell my collection just for a short-term requirement. The Unbolted facility meant the property deal could proceed and I got to keep my Art. I pay interest on the Unbolted loan but calculate that in the 12 months I will need the facility for, the increase in value will more than offset the interest.”

Mr and Mrs R: Setting up a coffee business

What the Client Says: “Looking after our families gold and securing it for the future is a big responsibility but we feel happy that in borrowing against it we can start an exciting new life for us and our daughters. The interest rate we pay Unbolted is affordable and we have flexibility on the loan size and length. The thought of having the gold in a secure vault fully insured back in the UK is very re-assuring too” Mr and Mrs R. (now happily settled in India).